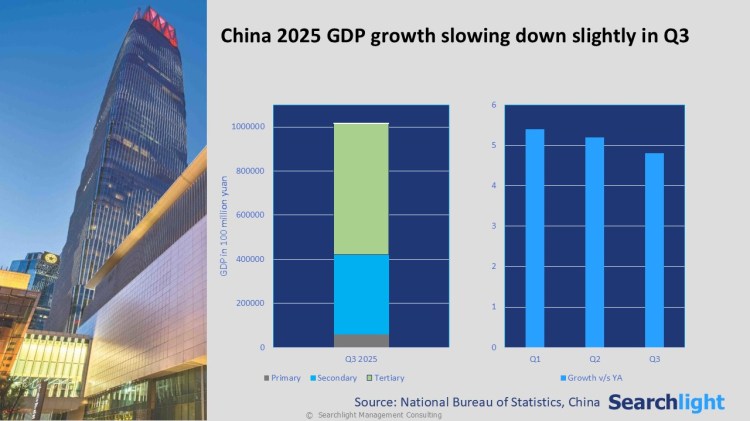

The latest economic data from China has some mixed signals. GDP is growing, although that growth rate has slowed a little bit from Q1 to Q3 of this year. Retail spending is also growing relative to 2024 but again, the growth rate is dropping as the months go by and retail spending growth drops below the GDP growth rate numbers. What might be driving this lack of consumer confidence?

The National Bureau of Statistics has released Q3 data for China and the GDP growth numbers are still positive. However, as we go from Q1 to Q3 there is a distinct slowing of the growth rate, with Q3 dropping below 5%.

The key for most businesses operating in China is, of course, consumer spending rather than GDP. Whenever those numbers exceed GDP growth, we see plenty of confidence in the economy from both businesses and consumers. However, if we look at the 2025 data, while there are a few months when consumer spending grew robustly (compared to 2024) and ahead of GDP growth, it starts to slow down as the months go by.

Even anecdotally, living in China, we notice trepidation on the part of consumers, reflected in business activities. Cab drivers often tell us their business has dropped off over the past few months, and we’re also seeing quick turnovers (closedowns and new startups) in retail service businesses around us (restaurants, spas and the like).

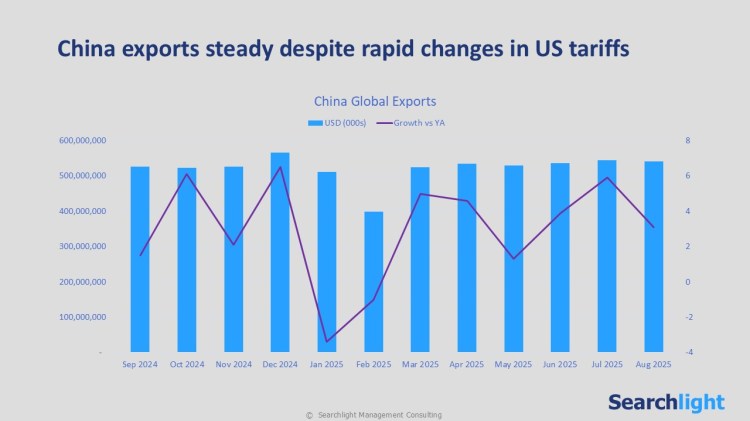

What might be driving this lack of consumer confidence? While the on-again, off-again tariff wars have the potential to affect trade, China doesn’t seem to be negatively impacted thus far. If the tariffs move from threats to actual long-term policy, there may be some effect on trade but so far there isn’t much to see here.

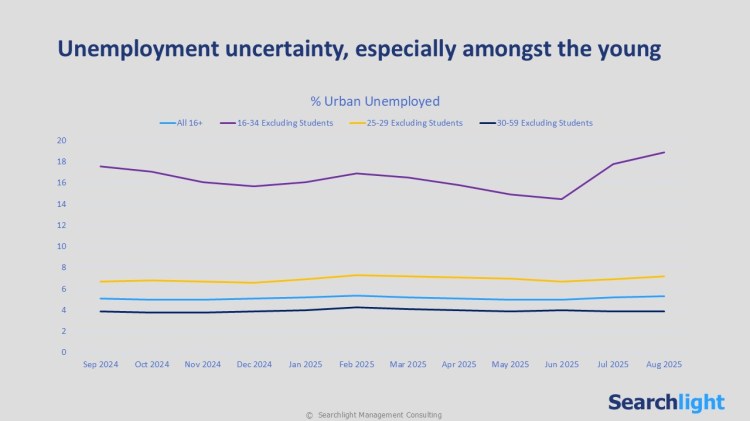

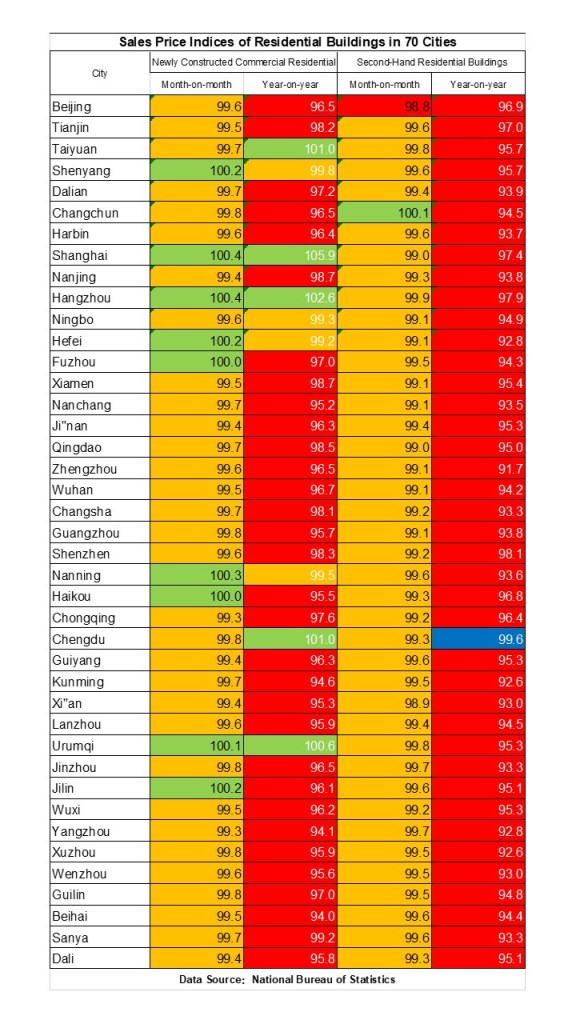

Two more likely factors might be the uncertainty of employment and the turbulence in the real-estate market caused by policy corrections in 2021 that eventually led to the collapse of Evergrande (China’s 2nd largest property developer) and similar existential crises for other players in the market.

Macroeconomic unemployment data can sometimes understate the uncertainty around employment. Looking at these figures, especially after removing students from the equation, shows that young people in particular have something quite concrete to worry about. While most young adults in China today have the safety net of inheritances from 3 families to fall back on (their parents as well as 2 sets of grandparents each), a lot of that wealth is tied up in real estate, which as we’ll see next, is also challenged.

That’s a long table with lots of very small numbers on it but briefly, each number is an index. We have indices for both new buildings as well as secondhand residential sales and they’re indexed against a year ago as well as month to month. Any indices of 100 or more are in green. 99 to 100 are in orange and anything below 99 is red.

Just a glance at the table will show you a lot of red – which means for the most part, real estate values across cities are dropping an entire percentage point or more. Juxtapose that against the steady rise of real estate prices over a 30 year period and the consistent drop shows a significant trend reversal. We’ve shown 40 cities in this table, the National Bureau of Statistics has data for 70 – the trend remains the same.

So, to sum up, the economy is still growing – though there are some signs of deceleration in recent months. Consumer spending has decelerated more acutely and it seems consumers are uncertain of the future, which holds retail spending back even when the economy is growing relatively fast. Unemployment and dropping real estate prices appear to be two elements that feed that uncertainty. Unemployment is particularly noticeable amongst youth, which may explain the disproportionate effect on retail spending.

Interestingly, however, online retail spending is growing – which is a topic we’ll cover in our next post. For the moment, the key thing to bear in mind is that retail spending and GDP are still growing – businesses should continue to be cautiously optimistic, choiceful in their focus markets and strategies but continue to invest in growth opportunities.

At Searchlight Consulting, we help clients identify markets, consumer segments and brand propositions that can unlock long-term growth. Get in touch on enquiries@searchlightchina.com if you’d like to talk to us about your China growth plans.